Consumers the world over have been affected by the economic downturn - but how are consumers faring in China, a country that thus far has been the more resilient to the economic impact? Starcom China partnered with Interface-Asia Holden to investigate the impact of the recession on consumer attitudes and behaviours across life stages and city tiers (A-B-C cities). We explored how consumers have changed pre-recession compared to today, and who is affected the most.

This is the first installation in Starcom’s Looking At Asia In A Global Economic Downturn series that will include future spotlights on Parenting, Brand Sirens, Category Highlights, Greater China and Asia.

In this first report, we look at A-B-C cities in China; at how they are faring during a global economic downturn, how they compare and contrast, what they are spending on, where they are saving, and how we can reach them.

Key China Recession Macro Trends:

1. Recession Amplifies China’s Extremes. Inherent disparities in China are made more pronounced by the recession across city tiers – from product category tradeoffs to media interactions. Insulated A cities are feeling positive but cautious, B cities heighten their value focus, while C cities are pushed back to the basics as they are dealing with the brunt of the recessionary impact.

2. Brand Loyal To Affordable Luxuries. In times of uncertainly, consumers stay with the brands that they can rely on. This is particularly true when it comes to categories which consumers consider to be their small luxuries. Branded shampoo, for example, is viewed as an alternative to actual, more costly, luxury items. In personal care, consumers do not want to skimp out on themselves.

3. Uncertainly Brings Out Creativity. To combat the downturn, consumers turn to creative solutions to make ends meet or get ahead. Some are turning entrepreneurial, while others are taking on courses to retrain or get new skill sets like English.

4. No Compromise On Education And Healthcare. Consumers are increasing their spend in education and maintaining their spend in healthcare, even in C cities.

5. Recession Has Impacted Consumer Messaging And Media Choices – But There Are Differences Across City Tiers. C cities remain traditionalist, turning to familiar media for immediate answers – newspapers, local magazines; for B cities, the recession brings out a true Value Consumer mindset and the Internet becomes the destination to satisfy value hunting; A cities turn more to in-home entertainment presenting the opportunity to reach even the discriminating viewers with escapist fair.

The A-B-C’s Of China’s Recession

A Cities

- Most positive group. A cities are more insulated from the recession due to greater mobility, professional development opportunities and purchasing power.

- While 64% feel that“the recession has affected China greatly”, 65% said they feel‘optimistic’.

- A cities have the most agility in category spending and are able to dial spending up or down. Personal luxuries (handbags, jewelry) and entertainment (dining out and in-home) are the first to decrease.

- TV benefits from the downturn as home-bound A city dwellers turn to in-home entertainment.

B Cities

- Less optimistic compared to A cities, but feel stable (49%) and neutral (44%).

- Overall B cities follow the pattern of Acities with regard to category usage, but just like a middle child, they straddle between A and C cities. Their decisions are not as driven by branding (A cities) nor price (C cities), but by value. 65% said “I feel that value is more important.”

- In these tougher times versus pre-downturn, B city consumers turn to the internet brand offers.

C Cities

- Most affected by the downturn and showing the greatest behavioural changes in

purchase and savings habit.

- C cities will not compromise on education or healthcare.

- They turn entrepreneurial to generate additional income and make ends meet.

- They increase their reliance on newspapers and magazines for deals/promotions.

Chinese Consumers Feel Protected

Chinese consumers are amongst the top ten most confident in the world. They acknowledge the downturn, but still feel that they are protected from it and have faith in the Chinese government due to their quick actions, such as the sizeable fiscal stimulus plan implemented at the end of 2008. In fact 73% agree that they “have confidence the government will help us through it all” and 72% say that “I feel like all of China is in this together and it gives me a sense of security.” On the whole, Chinese consumers are optimistic and hopeful, but still cautious.

Disparity In Consumer Outlook And Attitudes Across A-B-C City Tiers

Though the overall China story is optimistic, it is when we look at city tiers that the true story emerges. C city consumers are affected by the recession the most. Not surprising, C city had the highest percent of respondents(78%) agreeing that “I feel that the economic slowdown has affected China greatly”. The realistic, and relatively pessimistic, outlook from the C city respondents is likely driven by unemployment. Great number of migrant workers who have lost their jobs in the bigger industrial centres are returning home empty-handed, while C city workers are facing widespread factory closures, leaving them to struggle for survival.

Consumers Are Changing Their Purchase Behaviours

We asked our consumers what activities they tend to do ‘more of’ now versus pre-recession. The economic downturn has led to definite shopping and saving behavioural changes in all cities. Savings is tops, but many consumers have also become proactive. No longer are they passively sitting back or merely saving money via coupons. They have stepped beyond that to seize control of their finances by using their personal resources and adopting an entrepreneurial spirit.

Cut Spend

When consumers Cut Spend, they tend to reduce oreliminate spend on goods/services they consider nonessential,indulgences (e.g. daily coffee/tea, memberships,driving), they trade down to cheaper / private brands, orsimply stay at home vs. out spending money.

Buy Smart

To Buy Smart, consumers continue to make necessary purchases, but find smarter ways to get what they want. They will stick to their desired brand, but buy cheaper items within that brand portfolio, or save up for one higher end good vs. impulsively buying several cheaper products. They will also turn to affordable indulgences, like chocolate.

Proactive

The Proactive consumer is not content to merely decrease spending. Instead, they will take charge, adopt an entrepreneurial mindset and make things happen by starting

a side business, learning a new skill to better themselves, selling items, or finding free/low cost activities.

Saving

Those Saving will do exactly that, and ensure that they not only manage their spending, but that they also will set aside a part of their income.

C cities lead the way in all behavioural change categories, showing that they are the ones putting the most thought and effort into combating the recession. Interestingly, on top of cutting spending and buying smart, they have also been extremely proactive and have taken the reins in their financial situation. This is especially apparent when looking at C city parents. 85% of C city moms said they have started a side business to bring in more income since the beginning of the recession – the highest percentage out of any group. This area will be discussed in greater detail in Starcom’s Parenting in a Downturn installment.

Similar Category Tradeoffs Across City Tiers

Respondents from all city tiers follow similar trends in their spending patterns. Luxury and other big ticket items such as home décor and automotive, personal luxury items like jewelry, and out-of-home entertainment like dining out were the top categories consumers eschewed. Higher percentage of C city respondents reported ceasing spending on these categories versus their A and B city counterparts.

Consumers Turn To Affordable Luxuries

With cut-backs on high ticket items, consumers are turning to affordable luxuries to maintain a sense of their customary lifestyle while keeping within their means. To this end, items like chocolate, or in-home entertainment all serve to reinforce that they are managing fine and remain in control.

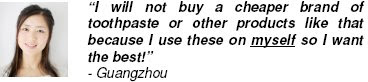

Personal Care Brands Are Non-Negotiable

In all cities, half of the top status quo items (those which respondents say they have not changed their spending on) are personal care items.

How has your spending in the following categories been affected by the recession?

Brand Loyal Despite Cutting Back

In the personal care category, respondents appear extremely brand-loyal, stating they would not compromise but will purchase their desired brand at regular price.

The myth-buster for China is that while consumers, especially those in C cities, are in savings mode, consumers will still not deviate from their desired brand. In this market, consumers are still learning about brands and are looking for cues regarding quality. Consumers will not always look to the cheapest product, but will make choiceful, value driven purchase decisions within their existent brand consideration set.

C Cities Invest In Education

Education was one of the categories that was immune to spending cuts and even experienced an increase in spend. This was especially the case for C cities where 28%

respondents reported increasing spend on education. C cities view education as an investment in giving their child more opportunities in life.

Contact Messaging Preferences Vary By City

Price discounts are the most popular across all city tiers, with 89% saying they feel that this is what companies ought to offer consumers. Females (the primary decisionmakers)in all cities say they would enjoy the benefits of coupons, free samples, and 2-for-1. However when it comes to consumer incentive programs, C cities are not as keen, as they appear driven by immediate gratification in savings and not the slim possibility of future prizes.

How companies can offer better value for consumers during a recession

A-B-C City Females

1. Product benefit explanations are especially powerful for C city consumers as they are still learning about products and desire product cues – especially in recessionary times when they cannot afford to make mistakes.

2. In store consultants on the other hand are not trusted by C city female consumers, as their trusted sources are overwhelmingly their personal network of family and friends.

3. C city consumers are seeking information and any way to make their lives easier is appreciated.

Key Learnings & What They Mean For Us As Marketers:

Recession Further Amplifies China’s Extremes

There is no one China, and the recession further deepens the cross-city tier disparities.

What this means to us as marketers?

Adopting a by-city tier approach starting with consumer/market research through to communications strategies and media choices will ensure consumer understanding that will lead to stronger consumer relevance.

Consumer Keep True To Their Affordable Luxury Brands

Consumers still perceive branding as a powerful quality reassurance, and will make effort to buy brands within their consideration set first, whether by trading-down on the product tier or waiting for a sale. Personal Care products and even affordable food indulgences, like chocolate, are perceived as the Affordable Luxuries. Price is only part of the equation, reinforcing the rightful brand choice is the other.

What this means to us as marketers?

Opportunity to maximize relevance of our products to the consumer in these tougher times. Making the choice easier(functional) and reassuring of the rightful brand choice (emotional) will deliver the total brand offer, and work to cement the consumer-brand bond.

Consumers Finding Creative Solutions To Combat The Recession

Consumers are increasingly relying more on themselves to get them through tough times. What are we as marketers doing to aid their ingenuity and entrepreneurial spirit?

What this means to us as marketers?

Explore opportunities to connect with these self-starting consumers by aiding them in their goals - equip them with necessary resources such as tips and tactics, facilitate access to forums for them to exchange ideas and experiences.

C Cities Uncompromising On Categories That Affect Their Future

C cities will not compromise on education or healthcare, as these are crucial in securing the best possible future for their children and for themselves.

What this means to us as marketers?

There are opportunities for brands to present an altruistic front by showing a desire to help by offering scholarships or education funds to C city children.

Messaging and Media Choices Differ By City Tier

A city consumers are turning more to in-home entertainment presenting opportunities to reach even the discriminating viewers with escapist fair. For B cities, the recession brings out the true Value Consumer mindset and Internet has become the destination to satisfy their value hunting. C cities remain traditionalist, turning to familiar media for immediate answers – newspapers, local magazines.

What this means to us as marketers?

Linking the content, context and contact in a meaningful way has never been more challenging than it is today. Consumers are more sophisticated, have more media choices and higher expectations of brands and advertisers. Understanding consumer media habits across city tiers is only part of the story; we need to better understand the role that each medium plays in consumer’s life and on the decision-making journey. The most powerful consumer connections can be created when we link the consumer with the brand through the right messaging and contact choices. And as we know, both the message and the contact will differ by city tier and consumer group.

>詳全文

.jpg)